On Libra and Governance

It is safe to say that most people do not spend much time thinking about how cryptocurrencies are governed. In fact, it’s wildly optimistic to assume that anyone outside of a small group of insiders have even considered the words “cryptocurrency”, “governance”, and “what is the best way to enforce cryptocurrency governance”. This is a niche topic, you are very busy, and wondering about the meeting minutes for a discussion on Bitcoin is probably not high on your list of priorities. However, in a world where traditional financial systems are considering decentralized forms of governance and our favorite photo sharing site has announced plans to debase the USD with a global currency, it warrants further consideration.

Before we dive into the structure of Libra and its constituents, let’s take a moment to discuss how cryptocurrencies like Bitcoin are operated. The code that governs Bitcoin and the protocol is called “Bitcoin Core” and you can look at it here. The website that hosts the code is an open-source repository, meaning that anyone can copy the code, request to make a change, or just generally inspect how it works. Unlike most technologies, the secret of how Bitcoin works is not what makes it valuable. Instead, it is the community that surrounds the technology and the history of all transactions that have occurred using it since inception. Saying that you are going to copy the code and create a new cryptocurrency does not automatically make it valuable. You also need to create demand for your community and convince people that you will steer the technology in a better direction. This process is called “forking” and generally results in some short-term price action as the market decides which version will retain users.

You may be thinking, “Who are the people that make these decisions anyway? Is there a CEO of Bitcoin?”

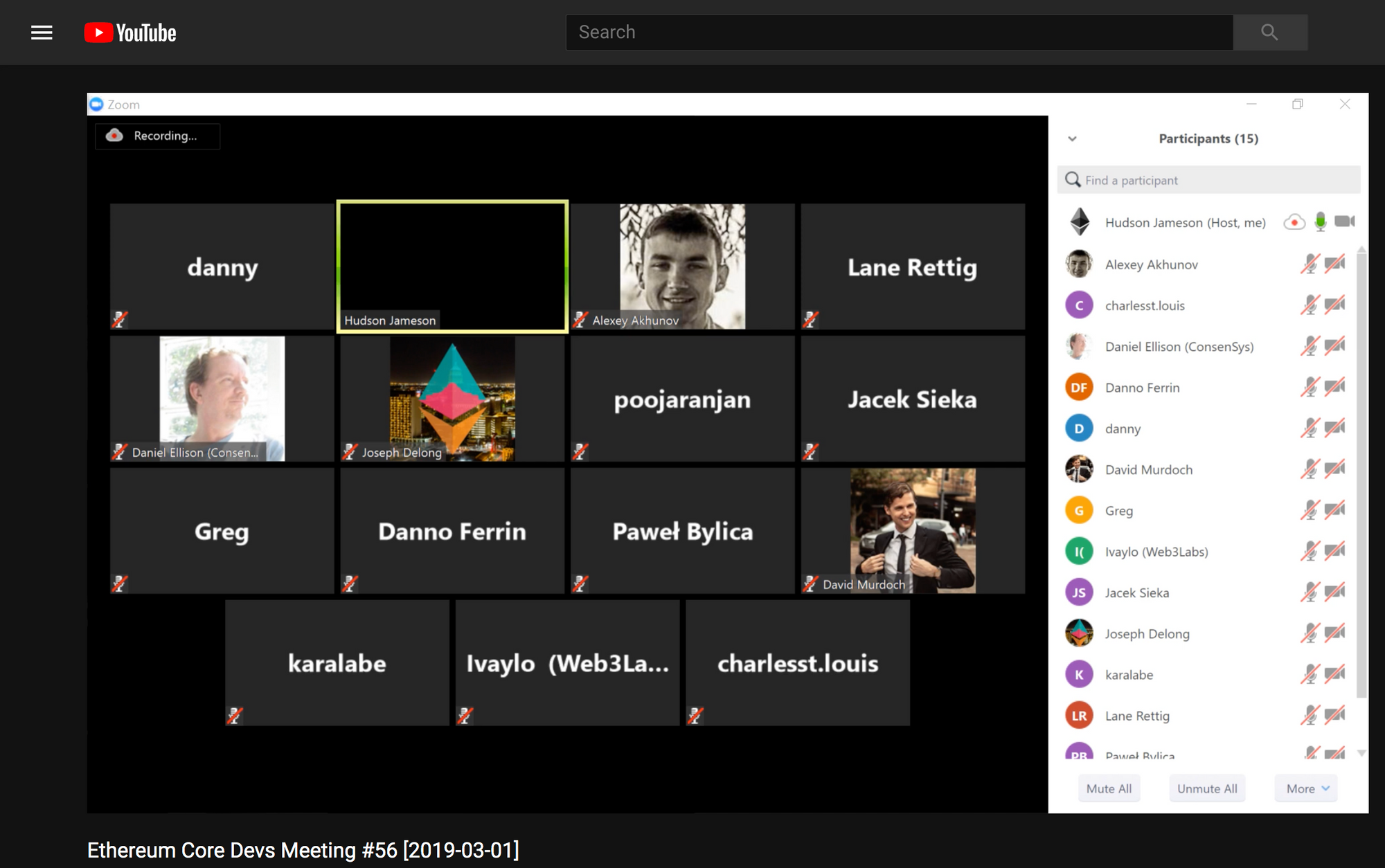

The dirty secret of the crypto industry is that all of the decisions being made around the development of the technology are done by self-appointed developers who usually meet via IRC or YouTube livestream.

These calls typically happen weekly and receive only a few thousand views, with a much smaller number of people who substantially contribute to the development effort. All of the calls are recorded and logs of the chats can be found hosted publicly. The Core development team is overwhelmingly male and U.S. centric.

Discussion over disagreements in the community typically happens over Twitter or during the weekly calls. Egos and interpersonal relationships dominate the decision making process, and it is generally a free-for-all on which topic is most important.

This is what “decentralization” looks like in practice.

The tradeoff in professionalism and formal policy is rewarded with autonomy and meritocracy. The developers do not have stake in Bitcoin outside of their personal investments, and they are not awarded special voting privileges outside of those gained through development contributions or informal influence in the community. The community is built from the bottom-up; developers create the product, and users seeking a way to transmit value or achieve a return on investment make up the demand.

It's a case of guerrillas versus an army.

Libra is creating an army:

The Libra Association is made up of a group of diverse organizations from around the world. The Founding Members of the association each run one of the validator nodes that form the network that operates the Libra Blockchain. One of the association's directives will be to work with the community to research and implement the transition to a permissionless network over time.

The announcement of the Libra Association yesterday arrived with much fanfare and a deluge of opinions from U.S. lawmakers, European finance representatives, and the usual suspects on Twitter. The general consensus is that the project is ambitious, vague, and operating in a regulatory grey area by a group of the world’s most powerful corporations.

There are 28 organizations currently listed on the Libra website as Founding Members, each of whom have pledged a $10M dollar stake to bootstrap the technical and operating costs. Here is how it works:

The $10M investment grants you access to “Libra Investment Tokens”, a financial construct that makes the holder eligible to receive dividends from interest received on funds held by the Association. The Investment Tokens also grant each organization a single vote on decisions made by the Association. Decisions like: how new members are added, which currencies should be used to makeup the basket of currencies that represent one Libra, and whether or not to operate in certain jurisdictions.

This answers one of the big questions that arise when any consortium is announced: what is the incentive for each organization to remain committed?

In this case, the answer is clear: the chance to make money.

This is actually reassuring. I can believe that the Founding Members share at least one overarching goal (aside from the nebulous concept of global financial inclusion), and that is the accumulation of capital. It’s what businesses are made to do.

When users buy Libra, the Association collects payment in the form of USD, EUR, GBP, whatever — and sticks it in a Swiss bank account. The Association then mints a corresponding amount of Libra based on the spot value of the payment, and the user is able to transfer their Libra globally through their digital wallet.

The end result: a massive influx of capital to an account operated by the world’s largest corporations in exchange for the use of a digital payments network. Unlike your bank account, the Libra Association will not grant you interest on your deposit. Instead, they will invest that money into the Reserve, which is:

[…] backed by a collection of low-volatility assets, such as bank deposits and short-term government securities in currencies from stable and reputable central banks.

Rather than relying on digital scarcity enforced by an algorithm, the Libra will be backed 1:1 by a basket of assets that have historically been considered low-risk. The result of this is that the Libra will pass off the downside risk to users, without the potential for appreciation outside of what is being distributed back to the Libra Association.

For now, membership within the Association is limited to a small group of companies that meet the requirements for membership; namely, having large userbases or significant global clout to assist with distribution. The white paper outlines a plan to grow the Association to 100 members composed of academic institutions, non-profits, and global companies.

The original Founding Members are composed of companies that have highly specialized technical teams and financial influence. It remains to be seen whether the coordination among these members will remain cohesive as new entrants join with competing priorities. I’ve said it before, but it’s worth repeating: the value of blockchain isn’t in the technology alone, but in the opportunity for traditionally competitive companies to collaborate on shared problems.

The key to success for a permissioned network is whether the strength of the shared incentives is enough to overcome the organizational inertia that causes companies to drift in strategy. Money is a powerful driver, but most companies have little patience for projects that don’t produce immediate ROI. And hey — if it doesn’t work, then I know a great group of guys with a YouTube channel they can join. I hear they’re doing pretty well.